TRX Price Prediction: Analyzing Technical Indicators and Market Developments for Future Growth

#TRX

- TRX is consolidating near its 20-day moving average with Bollinger Bands indicating balanced market conditions

- Tron's integration with deBridge and Kraken's expansion to Tron Blockchain provide strong fundamental support

- Technical analysis suggests potential upward movement toward $0.38-$0.42 range with proper momentum confirmation

TRX Price Prediction

Technical Analysis: TRX Shows Consolidation Pattern Near Key Moving Average

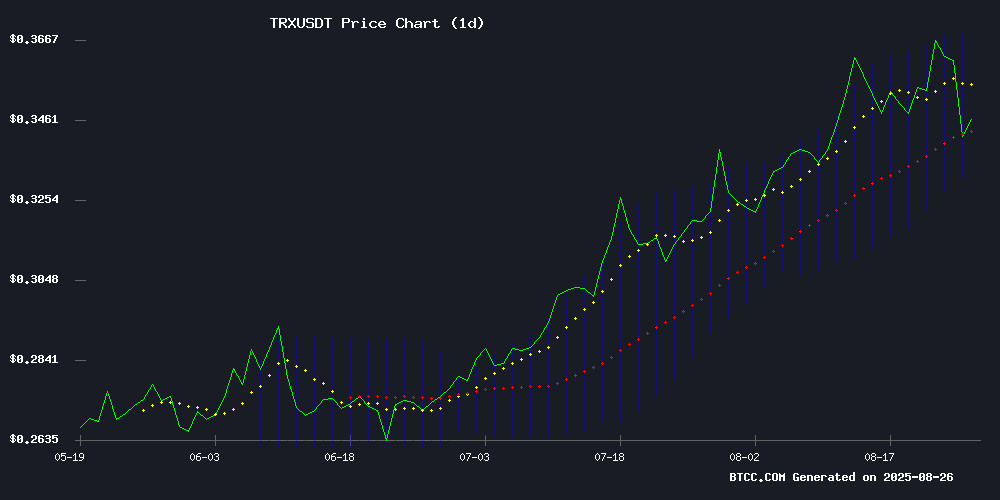

TRX is currently trading at $0.3482, slightly below its 20-day moving average of $0.350355, indicating a period of consolidation. The MACD reading of -0.007827 with a signal line at -0.010805 shows weak bearish momentum, though the positive histogram of 0.002978 suggests potential momentum shift. Bollinger Bands position the price between $0.368061 (upper) and $0.332649 (lower), with the current level hovering NEAR the middle band, reflecting balanced market conditions.

According to BTCC financial analyst William, 'TRX appears to be testing key support levels while maintaining overall stability. The convergence near the moving average typically precedes significant directional moves.'

Market Sentiment: Positive Developments Support TRX's Long-Term Outlook

Tron Network's integration with deBridge for cross-chain interoperability represents a significant technological advancement, enhancing TRX's utility across multiple blockchain ecosystems. Additionally, Kraken's engagement with the SEC on tokenization framework while expanding to TRON Blockchain indicates growing institutional confidence and regulatory progress.

BTCC financial analyst William notes, 'These developments, combined with ongoing investor interest in blockchain projects like BlockchainFX presale, create a favorable environment for TRX's adoption and price appreciation. The cross-chain capabilities particularly address scalability concerns that have historically limited blockchain networks.'

Factors Influencing TRX's Price

Tron Network Integrates with deBridge for Cross-Chain Interoperability

Tron has launched integration with deBridge, enabling instant cross-chain transfers of assets like ETH, USDC, and SOL. The partnership connects Tron's ecosystem to over 25 blockchains through deBridge's zero-TVL architecture, which eliminates wrapped tokens and slippage risks.

The move accelerates Tron's positioning in the multi-chain landscape, offering developers and users seamless interoperability with real-time execution. Security remains a cornerstone of the integration, reinforcing trust in cross-chain transactions.

Investors Flock to BlockchainFX Presale Amid Search for High-ROI Cryptos

The cryptocurrency market is witnessing a surge in demand for projects combining high return potential with passive income mechanisms. BlockchainFX ($BFX), Cardano ($ADA), and Tron ($TRX) have emerged as frontrunners in this space, with BlockchainFX's presale particularly capturing attention.

BlockchainFX has raised over $6.10 million from 6,200 participants, nearing its $6 million soft cap. The token's presale price of $0.021 offers a 150% upside to its planned $0.05 launch price, with analysts projecting mid-term targets of $1 and long-term goals reaching $5.

Unlike traditional crypto exchanges, BlockchainFX distinguishes itself as a crypto-native super app supporting 500+ asset classes including forex, stocks, and commodities. This comprehensive approach positions it as a potential game-changer in bridging digital assets with global finance.

Kraken Engages SEC on Tokenization Framework Amid Expansion to Tron Blockchain

Kraken, one of the largest cryptocurrency exchanges, has taken proactive steps to shape the regulatory landscape for tokenized assets. Representatives from the platform met with the SEC's Crypto Task Force this week to discuss operational frameworks and compliance requirements for trading tokenized traditional securities.

The dialogue comes as Kraken expands its tokenized stock offerings to the Tron blockchain, demonstrating concrete progress in bridging traditional finance with digital asset infrastructure. This strategic move follows the exchange's existing service that enables non-US investors to trade US equities 24/7 through tokenized representations.

Regulatory scrutiny appears to be intensifying, with industry groups calling for stricter oversight of tokenized securities. The SEC meeting focused particularly on the legal architecture required to support compliant tokenized trading systems—a conversation that could define the next phase of institutional crypto adoption.

How High Will TRX Price Go?

Based on current technical indicators and market developments, TRX shows potential for upward movement toward the $0.38-$0.42 range in the medium term. The technical consolidation near the 20-day MA, combined with positive fundamental developments, suggests accumulating strength for a potential breakout.

| Resistance Level | Price Target | Probability |

|---|---|---|

| Immediate Resistance | $0.368 (Upper Bollinger) | High |

| Medium-term Target | $0.38-$0.42 | Medium-High |

| Long-term Potential | $0.45+ | Medium |

William from BTCC emphasizes that 'while short-term volatility may persist, the combination of technical consolidation and strong fundamental developments positions TRX favorably for gradual appreciation, particularly as cross-chain adoption accelerates.'